Today more foreign companies than ever are opening a WFOE and it makes sense.

A WFOE gives overseas businesses an enviable opportunity to compete in China with a totally level playing playing field, operating as a fully legal, recognised company able to trade, manufacture, export, hire local and foreign staff, and, most importantly, only answer to themselves.

So, given that this company type is so important, let's explore our 3 key tips for running a WFOE in China successfully...

Why Open A WFOE In China?

No longer are you forced to create a joint venture and rely upon a local partner's good graces like in the bad old days of the 90's and early 2000's, or worse, exist in the grey zone of not operating completely legally in China.

We've written loads of blog posts about WFOEs, so take a look at them for even more information.

But opening a WFOE isn't always simple.

You may know that rarely in China are things completely simple and straightforward, although the best things in life seldom are. So in this post let us share with you 3 crucial tips for running a WFOE successfully, and manage it in a compliant manner moving forward when doing business in China...

Before we share the tips, let's just go over some of the key benefits that your Wholly Foreign Owned Enterprise will offer your business once it's up-and-running:

- You have total control of the business, not local partners

- You're legally able to hire both foreign and local staff

- Since you're not working with outsiders it's much easier to protect trademarks in China and other IP

- All profits belong to you and can be transferred abroad

- Your business license is valid for 15-30 years

- You may invoice in RMB and take payments locally

- These days the minimum registered capital threshold for a new WFOE is often zero (although this depends on city, region, and industry)

- Importing and exporting products is easier and cheaper, as you do not need to rely on a middleman

So this business allows you to trade or manufacture in China with very little impediment.

3 Crucial Tips For Running A WFOE In China Successfully

1. Decide if you're opening it with your overseas company, or starting a business in Hong Kong to do so

There is no problem with opening the WFOE using your overseas company, let's say in the USA for instance, as an investment vehicle for it.

However it may be that by opening aHong Kong company first and using it to open a WFOE you get additional benefits.

You'll potentially benefit from:

- A streamlined and cheaper way to repatriate profits, as international financial transfers are easier, not restricted by amounts, and cheaper in Hong Kong.

- Hong Kong companies can open a WFOE in China faster and with less demands than other foreign companies.

- The ability to deal with Mainland clients through the HK company and be protected by the territory's stricter rule of law.

TCBC can register your Hong Kong company for just RMB 6,800 (excl. government fees), and in around 2 weeks at most.

2. Be prepared to make the WFOE application

How do you prepare for something where the information is vague, mostly in Chinese, and involves processes and documentation which are often unfamiliar to you?Good question - it's tough.

That's why we created a WFOE setup checklist to guide you through the process and documents required by all foreign companies planning on opening their company here in plain English.

Perhaps the biggest issue facing you is one of language, since you'll need to deal with a lot of Mandarin Chinese, and also create a Chinese name for your new company (the English name is not legally recognised to the same degree, such as when on contracts).

For this reason it's going to be a lot easier and less time-consuming to get help from local experts who know the procedure inside and will get the company started ASAP. The sooner you're running, the sooner you're making money in China!

3. Take steps to make sure you're running your WFOE in a compliant manner

Just setting up the WFOE in China isn't really enough these days.China takes accounting very seriously, and is constantly vigilant for fraud. Whilst you may not be intending to do something wrong, just one small accounting error could have your business under the spotlight for all of the wrong reasons.

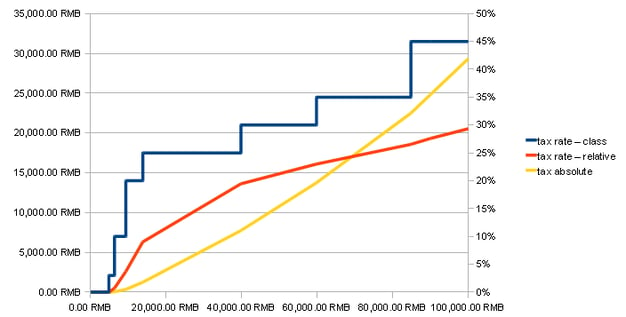

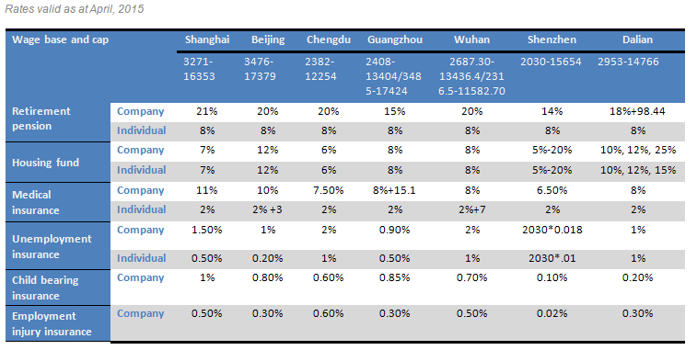

This is why making a plan to tackle China accounting, taxes, and annual auditing is important straight from go.

You could hire anaccountant, or outsource, but either way you're going to find that accounting, which is filed monthly, is very different to that of your home country.

Here at TCBC we suggest outsourcing, and since our accounting services are undertaken by expert local accountants who speak English and understand your company's needs, as well as starting from only RMB 1,200 per month for WFOEs, you'll find that this is far cheaper then hiring an accountant who could cost between RMB 5,000 to 8,000 per month in salary alone (and that's conservative).

Have your say on opening a China WFOE...

Are you currently thinking about starting a business in China? Whereabouts, and in which industry?

Would you consider starting a business in Hong Kong first before entering the Mainland?

Which elements of opening a China WFOE are attractive, or worrying to you?

Let us know any questions or concerns you may have by leaving them in the comments section at the bottom, and we'll answer them ASAP!