Brief Introduction to Shenzhen

Shenzhen is

located at the forefront of the Pearl River Delta

and borders on the New Territories of Hong Kong in the south, Daya Bay in the east, the outlet of Pearl River and Dongguan and Huizhou in the

north, being an important coastal communication hub in South China. Shenzhen is

the only city that owns seaports, airport and land ports in China. Its seaports

are especially developed. The Shenzhen Port ranks sixth among world container

ports. Shenzhen owns Luohu Port, the largest land passenger port in China and Huanggang Port,

the largest land freight port. At the same time, Guangshen, Shenshan, Jingjiu and Guangshen expressways link Hong Kong, Shenzhen and inland cities. 24-hour customs

clearance practiced by Shenzhen and Hong Kong ports, electronic inspection and

release and the commencement of construction of the West Bridge will make

Shenzhen and Hong Kong connected more closely. The regional advantages of

Shenzhen will be further highlighted and the economy of both Shenzhen and Hong

Kong can further thrive. Besides, Shenzhen is a bridge linking Hong Kong with

inland area and linking inland area with the world Supporting Industry Advantage

Shenzhen is a production base, R&D base and transaction base of high-tech products including computer and parts, communication equipment, audio visual products, optical and electromechanical products, biological engineering products, etc. Shenzhen has over 1500 factories producing supporting parts of computer, which produce almost all computer parts except chips. Their annual supporting ability is over 30 million sets. There are over 30 million lines for communication and exchange. Shenzhen has become an electronic supporting center in mainland China. China International High-tech Result Fair is held in Shenzhen once every year.

Shenzhen is a production base, R&D base and transaction base of high-tech products including computer and parts, communication equipment, audio visual products, optical and electromechanical products, biological engineering products, etc. Shenzhen has over 1500 factories producing supporting parts of computer, which produce almost all computer parts except chips. Their annual supporting ability is over 30 million sets. There are over 30 million lines for communication and exchange. Shenzhen has become an electronic supporting center in mainland China. China International High-tech Result Fair is held in Shenzhen once every year.

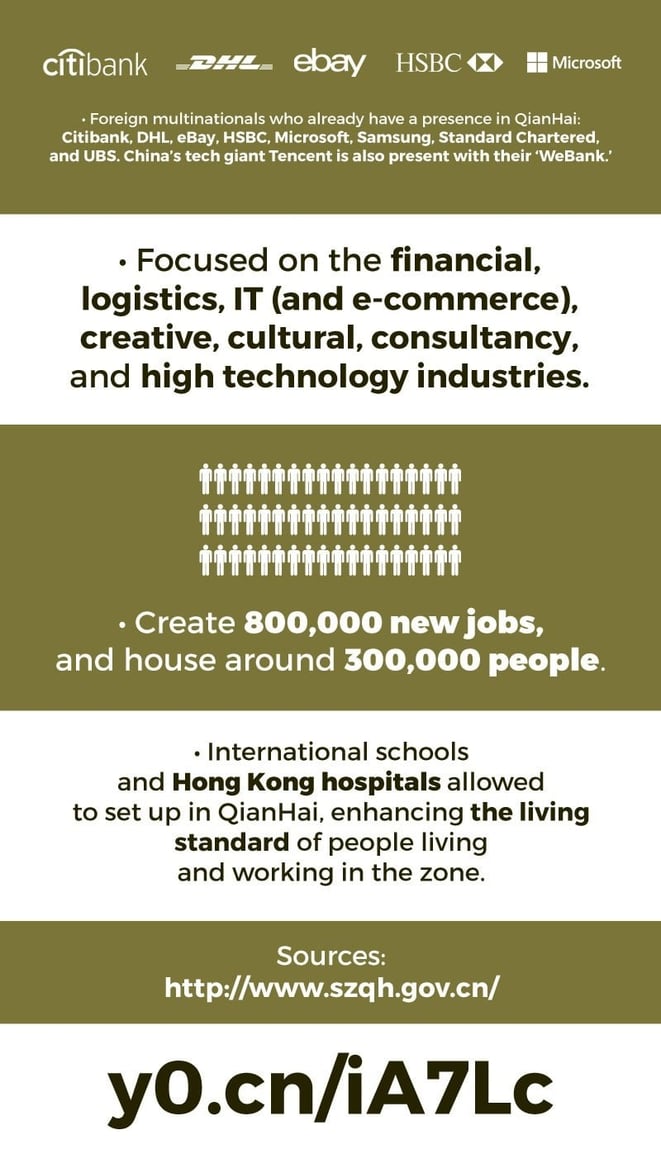

The

economic environment of Shenzhen consists of four pillar industries: high-tech,

modern logistics, financial services and the cultural industry. It is

noteworthy that Shenzhen is home to the Shenzhen Stock Exchange (SSE). The SSE

is a mutualized national stock exchange under the China Securities Regulatory

Commission that provides a venue for securities trading to a broad spectrum of

market participants, including over 1,500 listed companies as of 2014.

Due to

its close proximity Hong Kong, Shenzhen has strong economic ties with the

specially administered region. Hong Kong is its main export destination. In

2012, export to Hong Kong was US$146.37 billion, accounting for 53.94% of

Shenzhen's total export volume. Shenzhen has also managed to attract

substantial amounts of foreign direct investments---the utilized FDI in 2013

reached US$5.23billion, of which 34.4 percent went into the manufacturing

sector.

Under

State direction, Shenzhen aims to focus on innovation as its dominant strategy

for future development. The number of Shenzhen’s Patent Cooperation Treaty

application ranked first in China over eight consecutive years.

For

more information about Shenzhen, Please

visit http://english.sz.gov.cn/

http://en.szinvest.gov.cn/

Guideline

To Register Business In ShenZhen,Offer Complete Range Of Company Set Up

Corporate Formation Business Registration Services ShenZhen China

To facilitate people who want to invest and

set up company in Shenzhen, here is an introduction of Types of business

presence in China:

Before starting up a business in China, you

have to know what are the options. Foreign Investors generally establish a

business presence in China in one of five modes: Wholly Foreign Owned

Enterprise (WFOE); Representative Office; Foreign Invested Partnership

Enterprises (FIPE); Joint Venture and Hong Kong Holding Company.

Wholly

Foreign Owned Enterprise (WFOE) is a Limited liability company wholly owned

by the foreign investor. WFOE requires registered capital and it's liability of

equity , can generate income, pay tax in China and it's profit could be

repatriate back to investor's home country. Any enterprise in China which is

100 percent owned by a foreign company or companies can be called as WFOE. No.

minimum registered capital is required for WFOEs with scope of business of

consulting, Trading, retailing, information technology etc. in China. There are

minimum registered capital still required for some industries for instance:

Banking, Forwarding etc Since China still maintains foreign currency control

policy, it's still advisable to choose registered capital within RMB 100,000 ~

RMB 500,000 as the minimum registered capital. Companies can now determine how

much capital will be required to maintain their operations and must simply

ensure that they meet those targets within a period of 10 years.

Representative

Office (RO) is a Liaison Office of it's parent company. It requires no

registered capital. It's activities would be: product or service promotion,

market research of it's parent company's business, Quality Control liaison

office etc in China. RO generally is prohibited to generate any revenue nor

generating contracts with local businesses in China.

Joint

Venture (JV) is a Limited liability company formed between Chinese investor and

Foreign investor. The parties agree to create a entity by both contributing

equity, and they then share in the revenues, expenses, and control of the

enterprise. JV usually been used by foreign investor to engage the so called

restricted in areas such like: Education, Mining, Hospital etc.

Since

March 1, 2010, Measures of Establishment of Foreign Invested Partnership

Enterprises (FIPE) in China is taking effect. The regulation, which take

effect since March 1, 2010, are known as the Administrative Measures for the

Establishment of Partnership Enterprise in China by Foreign Enterprises or

Individuals. There's no required minimum registered capital for a Foreign

Invested Partnership Enterprise (FIPE) in Shanghai, Beijing, Shenzhen, Hangzhou

and rest cities of China

Hong

Kong Company usually been used as a Special Purpose vehicle (SPV) to invest

Mainland China. Hong Kong is one of the quickest locations to Incorporate a

business. Although a HK company is not a legal entity in Mainland China

(MainlandChina and Hong Kong, See Wiki 1 country, 2 systems), lots foreign

investors, especially investors from Europe and North America still chose to setting

up a Hong Kong company as SPV to invest China.

After China's entry to WTO, most industries

in China welcome foreign investment, WFOE setting up in China becomes the first

option of foreign investment's entity structures instead of Rep. Office setting

up in China At the mean time, for tax purpose, effective licensing system etc

more and more investors use Hong Kong as the holding company to invest China

mainland, using this offshore company to hold their operations in China.

Business set-up in Shenzhen is a big

project by itself, which requires financial and time commitments, business

management knowledge and China expertise. Identifying a competent agent to manage

the complex process will be a cost and time effective way to avoid potential

pitfalls

Since 2006, Tommy China

Business Consulting has been focusing on consulting services for our clients

to register company in ShenZhen. We offer a range of company formation services

including helping you to set up:

-Wholly Foreign Owned Enterprises (WFOE )

-Joint Ventures (Equity/Co-operative)

-Foreign Invested Partnership Enterprises

(FIPE)

Email: tomlee@tommyconsulting.com,

Skype: tomleeli

WhatSapp/Wechat/Cell Phone: +86 18926401128